When getting ready to apply for a mortgage loan you might not expect that your daily latte habit could be causing your interest rate to increase. The reason is your daily spending could be causing you to carry a debt load higher than the bank is comfortable with when you go to apply for a mortgage.

We spoke with David Katz a Mortgage Loan Officer with Advance Financial Group a division of Monarch Bank about debt-to-income ratios and how they can help or prevent you from buying a house.

The debt-to-income ratio is a metric that lenders use to determine if you can handle the additional payment of the loan you’re trying to qualify for – and mortgage loan officers will look at this number very carefully.

According to Katz, the actual debt-to-income ratio is determined by the loan type. Conventional Loans will typically have a ratio of 36%-38%. Government backed loans, like FHA and VA could have a slightly higher debt-to-income ratio of 41%-43%.

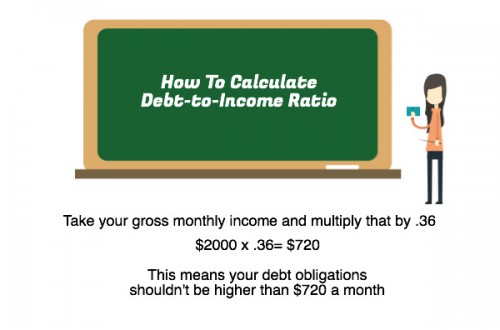

To calculate the debt-to-income ratio you need to take your gross monthly income and multiply that by .36 (the minimum debt-to-income ration percentage). The number you get is the maximum amount you can spend each month on revolving and installment debt.

There is a slight difference between revolving and installment debt. Revolving debt is credit cards, where the balances can fluctuate depending on your spending habits. Installment debt are purchases with a fixed repayment plan, including medical, student loans, and car notes. Both can influence the debt-to-income ratio in different ways. According to FannieMae.com monthly payments that have less than 10 payments left are typically not considered in the debt-to-income ratio, but could be included if the payment is very high.

Other factors that could help with the debt-to-income ratio is having a strong savings history, and no payment shock. Katz says that finding a mortgage payment that is similar to what you’re already paying in rent or mortgage can be favorable for home buyers. Some times these factors can increase the tolerance of the debt-to-income ratio but this is on a case-by-case basis.

“Good credit is not a compensating factor, good credit is expected,” says Katz.

Home buyers do need to pay attention to balances for credit cards – having a $500 balance on a credit card with a $5000 limit is significantly different than having a $4800 balance on the same card. Yet the balance isn’t the only thing to look at.

And while it is necessary to have a credit history with showing on-time payments the term “good debt” is a myth. Katz says, “There is no such thing as ‘good’ debt. We look at the overall credit picture. It is nice to see a variety of debt, both revolving and installment debt. We are more concerned with the required minimum payment than we are with the balance.”

For more information you can contact David Katz at 757-572-7251. He is a mortgage loan officer with Advance Financial Group a division of Monarch Bank. NMLSR #653697

All rates and programs are subject to change and based on borrower eligibility.